Whether you’re pursuing financing, courting investors, or preparing for a potential sale, one thing is universally true: your financials will be scrutinized. And not just at a high level.

Mergers and acquisitions are complex transactions that require careful planning and execution. One critical component of any M&A deal is navigating the tax obligations of both parties. In 2024, changes in tax regulations, evolving global economic conditions, and new compliance requirements are reshaping the tax landscape for M&A transactions.

After a slow year, the landscape of Mergers & Acquisitions (M&A) appears poised for a significant surge. With global economies stabilizing post-pandemic and a renewed sense of optimism prevailing in the business world, companies are gearing up to capitalize on strategic opportunities and drive growth through acquisitions.

You've likely heard about the U.S. Supreme Court's decision in the South Dakota vs. Wayfair, Inc. case, and its impacts on the e-commerce industry, consumers, and state and local governments. The June 2018 ruling overturned decades of precedent when it comes to the taxation of revenue from out-of-state sales, allowing states to collect tax where they previously could not.

But did you know that the ruling will also impact buyers and sellers of businesses?

The recently passed Tax Cuts + Jobs Act (TCJA) includes changes that impact almost all aspects of the current tax system. Some of these changes will also directly impact the volume of mergers and acquisitions (M+A) we see happening across the country in the near term, as well as the way deals are modeled and negotiated.

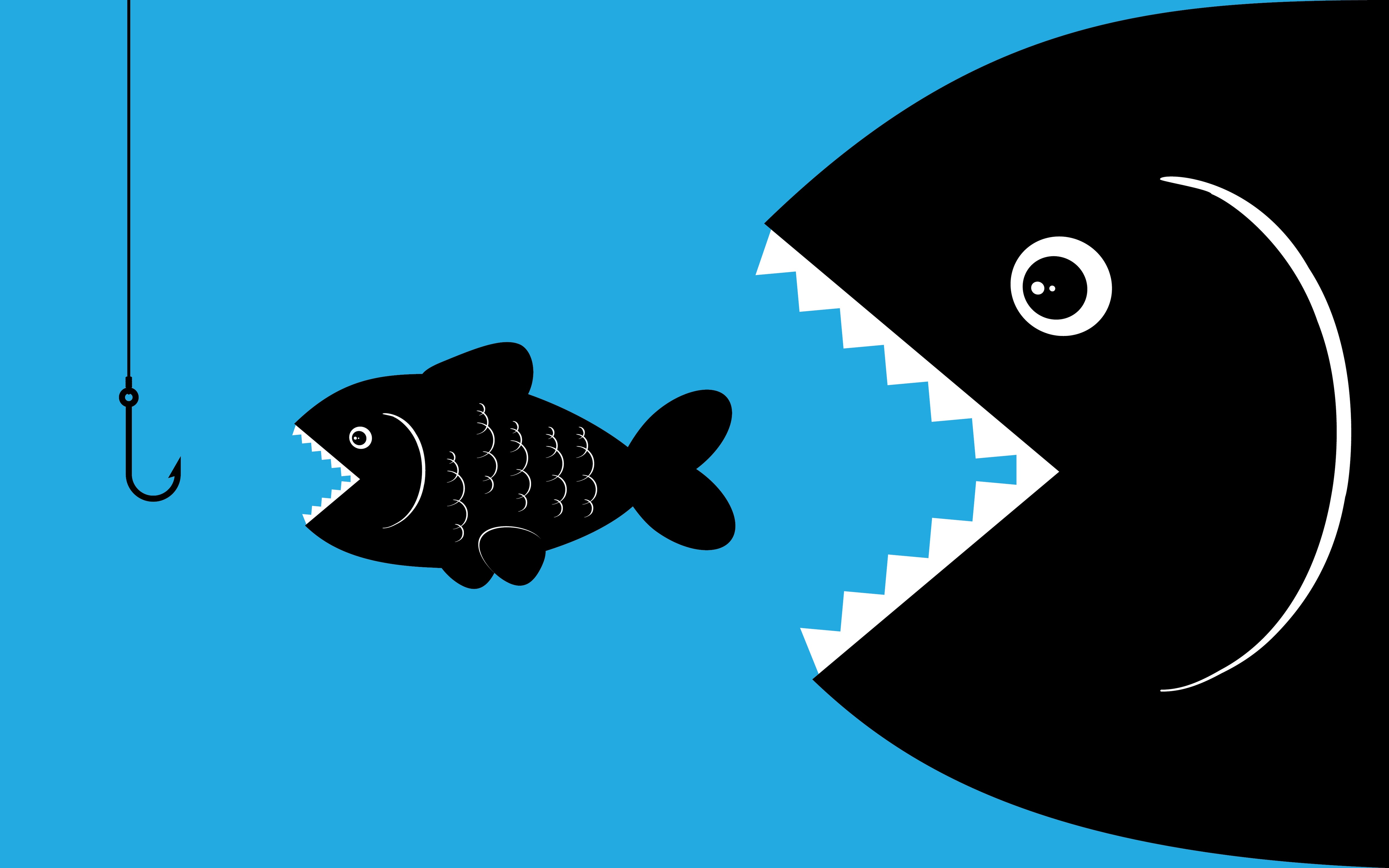

I’ve helped countless business owners sell their businesses over the years. On the other side of the spectrum, I’ve also helped business owners expand their businesses through mergers and acquisitions (M+A). The benefits that can come from M+A are numerous.

Below, I’ve outlined some of the top reasons our clients have decided to merge with or acquire a new business: